When Gov. Inslee rolled out his $39 billion budget in December, it was accompanied by charts showing state tax collections had shrunk over the past two decades when measured against personal income growth.

The logical conclusion: We need more taxes.

The problem, however, with using personal income growth as the standard for government growth is that it implies that government should grow and prosper at the same rate as its citizens.

This perspective fails to recognize the existence of core functions or roles of government, and the subsequent constraints on taxation that the government take only as much as needed to fulfill those roles.

Under this view, government growth has no borders, and its authority to regulate and control our lives is without limit.

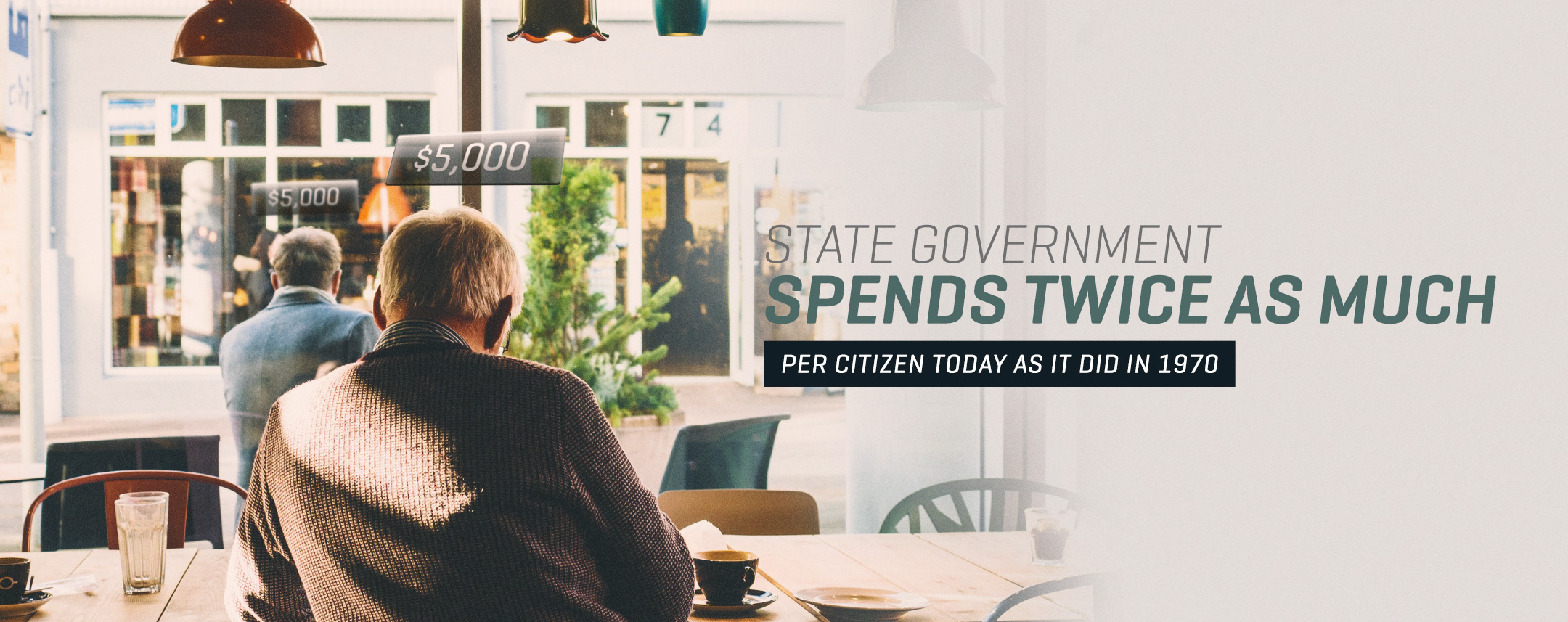

A much more meaningful measure of government growth is inflation-adjusted per capita spending. On that front, it’s a rather bleak picture in Washington.

Since 1970, total state spending has more than doubled, from $2,156 to $5,004 per capita in 2014.

Basically, our state government is twice the size it was in 1970 in real terms. What are we getting for all that extra spending? Are our secondary schools twice as productive? Has the quality of our higher education institutions doubled? Are we twice as safe (and is this even desirable)? Is state government twice as efficient at achieving the desired results for citizens?

Conversely, in 1970 were we bordering on Somalia-level services?

Even if the theoretical answer to all of these questions was yes (though I doubt even the state’s most ardent cheerleaders would make that argument), the indisputable takeaway from Washington’s real per capita spending data is that state government is twice as big as it was four decades ago.

We are spending twice as much per citizen. Let’s not pretend that raising taxes is a state emergency. We will not devolve into a failed state if spending only grows at 8.6 percent (expected revenue growth) as opposed to 16 percent (Gov. Inslee’s desired revenue growth with new taxes).

If Inslee and other tax supporters want to expand the role of government, then let’s have that honest conversation. But please drop the pretense that just keeping up with current priorities requires $1.4 billion in new carbon and capital gains taxes.