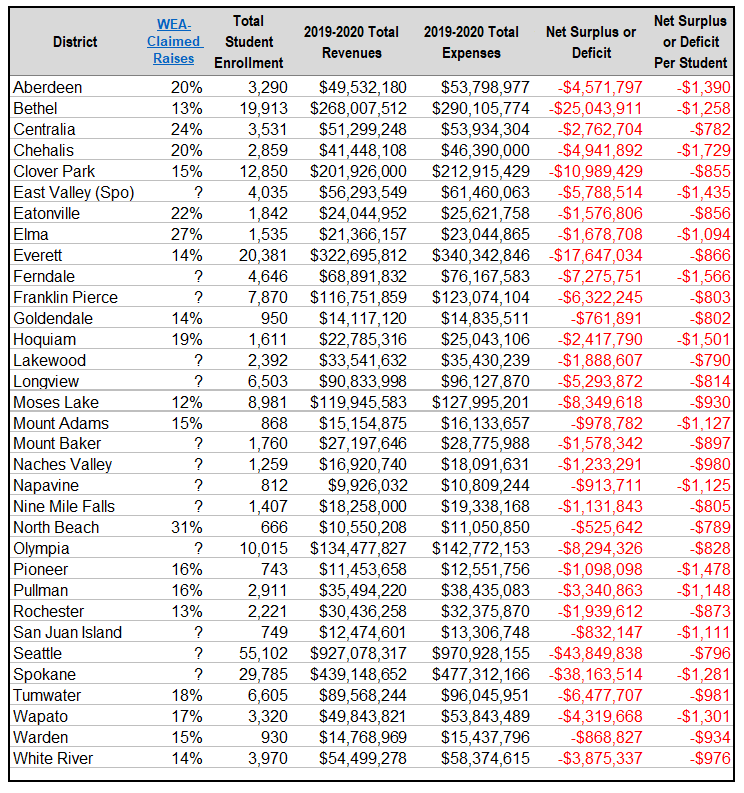

Gov. Jay Inslee’s school levy property tax increase, Senate Bill 5313, continues its path through the Washington State Legislature.

This is due to the crisis in school budgets created by union bargaining. Although districts were expected to stop using levy funds on salary enhancements, the combination of union hard bargaining and acquiescent school boards rendered these laws meaningless. Now many districts are going broke because the large pay raises they awarded are unfunded and unsustainable.

See entire table of all districts here.

Four laws were supposed to provide sideboards to prevent unions from getting more than their share of the new funds the state provided. They were:

- RCW 28A.400.200 (4) c (ii), prohibiting the use of enrichment local school levies for basic education wages effective September 2019;

- RCW 28A.505.040, the obligation to demonstrate a four-year budget plan showing sustainability;

- C 299 L 18, the state operating budget, Section 503 of which specifies that the allocation for basic education teacher salary was to average $65,216 plus any regionalization factors for 2018-19 (additional pay for additional time at an employee’s established hourly rate remains possible); and,

- RCW 41.59.800, the assurance that in the transition year of 2018-19 certificated employee salaries would not increase at a rate greater than state provision plus inflation.

Sensible budgeting was dismissed as school boards could not resist pressure and illegal strikes or they simply wanted to support the union interest above all others. Unfortunately, young teachers, classified staff raises, class sizes, supplemental educational opportunities and other school services will all be sacrificed to fund the WEA-won raises.

Unless WEA and the district insiders can shift the burden back to taxpayers. That’s what the governor, the superintendent of public instruction and other lawmakers want to do.

The Senate Bill 5313 fiscal note estimates the annual property tax increase:

The range of increased local enrichment levy is estimated to be between $354.7 million and $590.3 million in calendar year 2020 …

These new funds are not to restore services to families, to reduce class sizes, extend learning opportunities or offer great new supplemental education opportunities to children. They are simply to bail out districts that are already subjugating those values to the union pay demands.

Washington residents will be paying higher state property taxes and higher local property taxes and receiving less in services to families than they did before the tremendous funding increases.

Acknowledgement

Special thanks to the amazing data assembly work of Jeff Heckathorn at the School Data Project. Jeff is an independent researcher who has been analyzing Washington State’s K-12 school data for more than 15 years. He uses state sources and presents data on a website at SchoolDataProject.com

Related:

“Jami Lund: Schools Don’t Need Another Property Tax Hike,” Spokesman Review, March 7, 2019

WEA’s Property Tax Increase To Cover Unsustainable Union Contracts

How Broke Did Union Bargaining Make Your District?

What Can Be Learned From The Ferry System About Teacher Strikes?

If teacher strikes are illegal, why do they happen?

Tacoma teacher strike prompts legislators to hint at new property taxes

Has the legislature fixed public education?

Teachers In Mabton Are Marching For A 17 Percent Raise

Breaking community colleges for unions

Local offices to be filled this year

State superintendent favors union power

Senate nearly fixes education funding loophole

Open Letter to Lawmakers: Restore Sideboards on Collective Bargaining

Teachers union bargaining to steal materials from children

SPI Sues to End WEA’s Damage to Funding

Superintendent Dorn Acknowledges Union Abuse of Public Interest